Risk of exchange rate fluctuation: Insulated by futures and options contracts

- available for businesses in developed economies

- other: government need to manage exchange rate

Central bank:

- buy its own currency in forex market = support exchange rate, side effect: reducing money supply

- buying domestic bonds = increase money supply

- purchase in forex + buying domestic bonds = sterilize its action on money supply

Capital control: Taxes or restrictions on international transactions in assets like stocks or bonds

Exchange control: capital controls applied specifically to foreign exchange

- The conventional wisdom of the economics profession has been that capital controls are ineffective and impose substantial costs.

- China government: willing and able to rigorously enforce capital controls on both inflows and outflows; and which maintains substantial control over the domestic financial system, capital controls are more likely to be effective

- Regulate outflow: domestic purchase of foreign assets

- Regulate inflow: foreign purchases of domestic assets (reduces the amount of hot money, which likely to move out in a crisis, and thereby facilitates the controls on outflows)

Price of a stable exchange rate: unstable short-term interest rates

Balance of payments of a country 1 2:

- BOP = Current account + Broadly defined capital account

- IMF definition: BOP = current account + capital account + financial account

- current account: country’s trade balance (include income from loans

and investments or transfer payments)

- current account balance = national saving – national investment

- capital account: transactions of capital assets, no impact on country’s

production, rate of savings, or income

- domestic ownership of foreign assets and foreign ownership of domestic assets

- broadly definied: include central bank reserves; otherwise exclude

- credit in current account = debit in capital account, vice versa

- Balancing BOP:

- raise exchange rate, hurt export & make import cheaper, also make domestic investment assets less attractive

- inflation, make export less competitive

Foreign Investment 3:

- Direct investment: Establishing a direct business interest

- Portfolio investment: Investing in financial assets such as stocks or bonds

Businesses and currency exchange rate

- Chinese goods cheaper compared to their U.S. counterparts, making it more difficult for the U.S. firms to compete in common markets

- Chinese export (peaked in 2008) → Growth

- Growth + high domestic savings rate → current account surpluses + capital account deficit

- high saving, high export = low import, thus current account surplus

- capital account deficit = accumulation of foreign exchange reserve

- Chinese capital control + capital account deficit = internationally

denominated bonds held by authorities (became foreign exchange reserves)

- low rate of return asset, but very liquid

- forex reserve help defend domestic currency against speculative attack or to recapitalize the domestic banking system in case of a financial crisis

China export declined in 2009–2015

- forecasted real growth decline → forecasted interest rate & demand of CNY decline

- current account surplus at 2–4% GDP (still healthy)

- capital account declined: balances on direct/portfolio/other investment become more negative

- result: decline in forex reserve (selling USD to maintain CNY value) since June 2014

- Chinese firms repaying fireign debt

- Chinese resident seeking to hold foreign assets

- switch of ownership of foreign assets from official to private Chinese portfolios

Chen and Orlik (2016)4 calculate the adequacy of Chinese foreign exchange reserves under alternative assumptions about the effectiveness of Chinese capital controls.

- IMF recommendation: depends on exchange rate is floating or fixed and whether has effective capital control

- IMF methodology: weighted average of exports, short-term foreign debt, other foreign libabilities, and money supply

- China: fixed exchange rate regime

- if capital control effective: reserve should equal to 10% annual export + 30% short-term debt + 20% other foreign liabilities + 5% of M2 (USD $1.8 Tn)

- if capital control ineffective: need $2.9 trillion

- PBOC held $3.3 trillion as of December 2015

Maintain exchange rate target and economic conditions created a demand for foreign assets and drained reserves

- Problem can be solved by positive shocks, e.g., an increase in expected growth that raises demand for domestic assets, without the need for a major policy change

Four policy choices to stem reserve losses:

- tighten capital controls: reduce demand for foreign assets

- tighter monetary policy (higher interest rates): reduce demand for foreign assets

- devalue the CNY substantially

- continuing to sell off reserves gradually and hoping that conditions improve

Tighten capital control:

- people are ingenious at moving money around

- imperfect capital controls tend to become “leakier ” over time.

- Tightening capital controls would counter to the longer-run goal to reduce financial regulation and increase the international use of CNY

- interfere with the efficient allocation of resources, at the cost of Chinese residents; no measurable effect on U.S. economy

Monetary or fiscal policy:

- Tighter monetary policy and expansive fiscal policy have opposite effects

on GDP but both tend to raise domestic interest rates and thereby

strengthen the CNY

- both: expand money supply to encourage economic growth

- fiscal policy (government): tax cut, rebates, govenment spending

- monetary policy (PBOC): open market operations, reserve requirements, interest rates

- significant fiscal expansion = expensive and increase the debt-to-GDP ratio

- fiscal policy takes time to formulate and implement and is difficult to adjust rapidly

- monetary tightening would have the very undesirable side effect of slowing domestic growth

- Growth remains a major priority for the Chinese authorities

- PBOC maintain liquidity and steady credit growth

- have effects on GDP, impacts U.S. exports, but U.S. exports to China account for only a very small proportion

Devalue the CNY:

- Asset shift to non-CNY assets

- tighter capital controls would seek to prevent markets from making this asset shift

- monetary or fiscal policy would change the fundamentals to make asset demand consistent with the desired exchange rate

- devalue CNY substantially to reduce domestic purchases of foreign assets by making them more expensive and presumably reducing expectations of future returns

- if such a devaluation is to reduce fear of future devaluation, it must be substantial

- small devaluation that simply increases expectations of future devaluations

- often find that such devaluations provoke inflation

- let CNY float freely: Chinese business have to cope with the uncertainty about the future exchange rate

Defer a decision and continue to sell off reserves

- sell off their foreign exchange reserves to domestic residents

- entire forex reserve portfolio: $3 trillion

- USD 1.8 trillion in U.S. securities (USD 1.25 trillion treasuries, USD 500 billion agency and corporate debt)

- sale of the whole $3 trillion forex reserve might raise U.S. yields by 20–30 b.p. along the yield curve

- if sales is merely a transfer of assets from Chinese authorities to Chinese residents, they might not have any effect at all

- effect of a sale probably much smaller than QE: Chinese sale of U.S. assets cannot signal market participants about future Federal Reserve policy

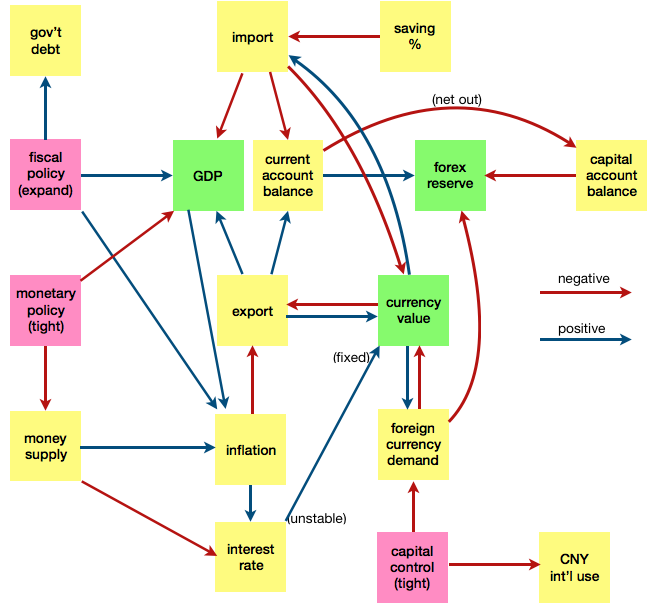

Diagram summarizing dynamics between different components (roughly):

-

https://www.investopedia.com/ask/answers/060115/what-difference-between-foreign-portfolio-investment-and-foreign-direct-investment.asp ↩

-

Fielding Chen and Tom Orlick, “Something in reserve? Assessing China’s FX buffer”, Bloomberg Professional, 1 Feb 2016. ↩

Bibliographic data

@techreport{

title = "Chinese Foreign Exchange Reserves, Policy Choices and the U.S. Economy",

author = "Christopher J. Neely",

number = "Working paper 2017-001A",

institution = "Federal Reserve Bank of St. Louis Research Division",

year = "2017",

month = "January",

doi = "10.20955/wp.2017.001",

}